How Hedge Funds Leverage AI for Aggressive Benefit

Introduction

Hedge funds handle billions of {dollars} globally, and their success depends upon their capacity to remain forward of market developments. As AI continues to reshape industries, hedge funds have been fast to undertake its capabilities. Whether or not it’s AI predicting market crashes or optimizing portfolios, the potential for AI to boost decision-making is immense. Let’s delve into how this transformation unfolds.

The Significance of Aggressive Benefit in Hedge Funds

To outlive in unstable markets, hedge funds should constantly outperform benchmarks. This requires:

- Entry to superior knowledge insights.

- Fast adaptation to market dynamics.

- Methods that outpace opponents.

Conventional strategies are now not enough. AI, with its capacity to course of and interpret huge datasets, presents an important aggressive benefit. It permits hedge funds to navigate complexities with velocity and precision.

Key Functions of AI in Hedge Funds

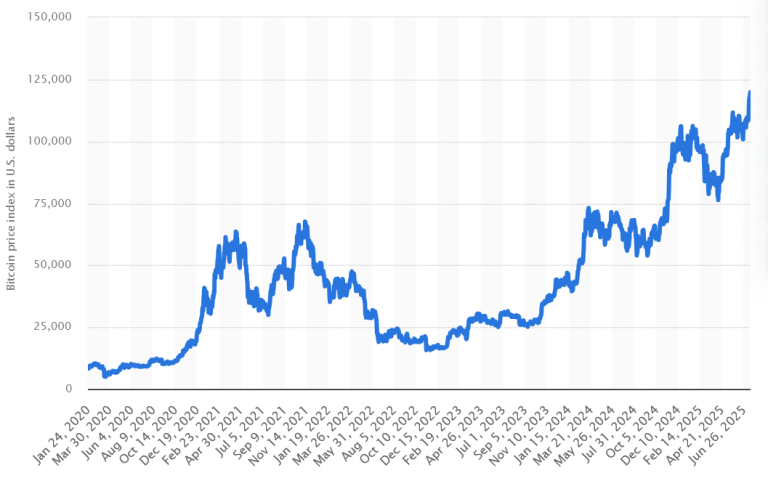

Knowledge Evaluation and Prediction Fashions

AI thrives in analyzing huge datasets. Hedge funds use it to:

- Establish correlations between belongings.

- Forecast market developments based mostly on historic knowledge.

- Develop predictive fashions, reminiscent of AI predicting market crashes, which assist mitigate dangers throughout financial downturns.

Algorithmic and Excessive-Frequency Buying and selling

AI powers algorithmic buying and selling by:

- Analyzing real-time market knowledge for optimum commerce execution.

- Exploiting market inefficiencies inside milliseconds.

Excessive-frequency buying and selling, fueled by AI, supplies hedge funds with a decisive velocity benefit.

Danger Administration and Portfolio Optimization

Incorporating machine studying in portfolio administration permits hedge funds to:

- Alter portfolios dynamically based mostly on threat components.

- Predict and mitigate potential losses utilizing stress checks.

- Obtain higher diversification by figuring out uncorrelated belongings.

Sentiment Evaluation and Different Knowledge Sources

AI instruments scrape various knowledge sources like social media and information shops to gauge market sentiment. That is particularly helpful for understanding:

- Public opinion on trending belongings.

- Political and financial occasions affecting the market.

For instance, if sentiment round renewable vitality investments is optimistic, AI can recommend changes in portfolios specializing in AI in ESG investing.

Advantages of AI in Hedge Funds

Enhanced Determination-Making

AI equips hedge funds with actionable insights by figuring out patterns and developments people could overlook. This leads to:

- Extra correct predictions.

- Higher timing of trades.

- Knowledgeable long-term methods.

Effectivity and Value Financial savings

Automating duties reminiscent of knowledge processing and commerce execution reduces operational prices. AI additionally streamlines compliance monitoring and reporting.

Improved Danger Administration

AI’s predictive capabilities assist hedge funds foresee dangers and take preemptive motion. This contains detecting market anomalies and mitigating their impression earlier than they escalate.

Enhanced ESG Investing

AI permits hedge funds to align with Environmental, Social, and Governance (ESG) rules. By analyzing ESG metrics, funds can:

- Establish sustainable funding alternatives.

- Keep away from corporations with poor ESG scores.

- Strengthen their status amongst socially aware buyers.

Challenges and Limitations

Excessive Prices of Implementation

AI adoption requires vital funding in know-how and expertise. Constructing and sustaining AI programs generally is a monetary pressure, particularly for smaller funds.

Knowledge High quality Points

AI depends on correct and complete knowledge. Incomplete or biased datasets can result in flawed predictions, negatively impacting fund efficiency.

Moral Issues and Regulatory Dangers

AI fashions function as black containers, making it troublesome to elucidate decision-making processes. This lack of transparency raises moral questions and regulatory scrutiny.

Dependence on AI

Over-reliance on AI poses dangers. Algorithms can fail to adapt to unexpected occasions, reminiscent of geopolitical crises or sudden regulatory modifications, necessitating human oversight.

Actual-World Examples of Hedge Funds Utilizing AI

Success Tales

- Renaissance Applied sciences: Identified for its Medallion Fund, this hedge fund makes use of AI and quantitative fashions to realize extraordinary returns.

- Two Sigma: A pacesetter in leveraging machine studying to handle investments, specializing in patterns that drive market dynamics.

- Citadel: Combines AI with human experience for high-frequency buying and selling and threat administration.

Classes from Failures

- Poorly carried out AI methods can amplify dangers. As an illustration, funds that relied solely on algorithms throughout sudden market occasions suffered losses, highlighting the significance of hybrid approaches.

The Way forward for AI in Hedge Funds

Rising Traits

- Quantum Computing: Anticipated to revolutionize AI capabilities by fixing complicated issues sooner than ever.

- Deep Reinforcement Studying: Enhancing AI’s capacity to make choices in unsure environments.

- AI in ESG Investing: Rising demand for sustainable investments will push funds to make use of AI for figuring out moral alternatives.

The Hybrid Mannequin

The long run lies in combining AI’s computational energy with human instinct. Whereas AI handles repetitive duties and knowledge evaluation, human managers give attention to technique and moral concerns.

Conclusion

AI has remodeled hedge fund operations by enhancing effectivity, decision-making, and threat administration. Whether or not it’s AI predicting market crashes or optimizing portfolios via machine studying in portfolio administration, the advantages are simple. Nevertheless, challenges reminiscent of excessive prices and moral issues have to be addressed.

Because the synergy between AI and human experience evolves, hedge funds will proceed to push the boundaries of innovation, leveraging instruments like AI in ESG investing to remain aggressive. The important thing to success lies in hanging the best stability between know-how and human judgment.