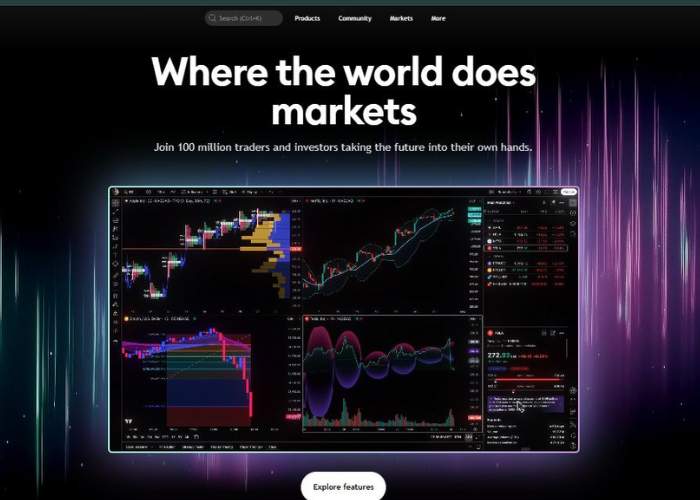

You join TradingView considering it’s “simply charts,” however shortly uncover it’s extra like a buying and selling working system. Not an AI‑bot within the traditional sense—it’s extra like a bot launchpad. You construct methods in Pine Script, backtest them, and fireplace alerts which you’ll webhook into execution techniques. Acquired your adrenaline pumping but?

What Precisely Is TradingView?

TradingView is primarily a charting and technique improvement platform—used throughout shares, crypto, foreign exchange, commodities, indices—providing backtesting, scripting, group code, and real-time alerts. It doesn’t execute trades itself—however integrates tightly with third‑social gathering bot companies through alert webhooks.

So sure, it’s a software for constructing and validating your AI‑fashion methods—however execution lives elsewhere. Think about TradingView because the engine room the place information meets selections, and bots outdoors fireplace off orders when circumstances are met.

Characteristic Tour: What It Brings (and Leaves Out)

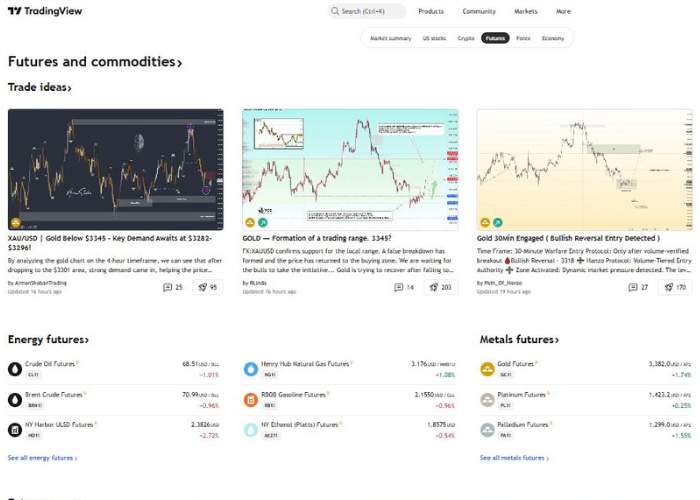

- Pine Script Technique Builder

Write or tweak methods utilizing built-in or customized code—RSI crossovers, MACD triggers, candle patterns, you identify it. Backtest straight on chart. - Alert System with Webhook Assist

You outline the circumstances, embed webhook URL and payload format—integration platforms then act on alerts to execute actual trades. - Group & Market

Tons of shared scripts and methods. You’ll be able to import group instruments, learn suggestions, and adapt them. Nice crowd‑sourced intelligence. - Paper Buying and selling Simulator

Run your methods in demo mode earlier than risking actual cash—tremendous useful for debugging and confidence-building. - Knowledge & Dealer Integration

Entry real-time historic information, and join with brokers through third-party instruments like Tickerly, Cornix, WunderTrading, TradersPost, and many others.

My Journey: From Setup to (Nearly) Stay Trades

I began scribbling a easy MA crossover Pine Script technique, ran it by backtest—it seemed promising. That buzz of charts turning inexperienced? Priceless. Then I arrange an alert with a webhook to a trial bot supplier. Set it to paper‑commerce.

Week one: alerts triggered, trades logged. Paper P&L? Meh—small pips right here, tiny losses there. Felt like steering a ship by fog: promising, however nerve-wracking when hits dried up.

Then group script I borrowed flagged a reversal candle sample that coincided with a sudden transfer in ETH. I noticed the alert, jumped in myself—not totally automated. That little 2% transfer on paper felt like validation. Emotional excessive.

However alerts mis-fired one morning (bug in my code), and that despatched me spiraling into technique debugging. The group boards have been lifesavers—somebody had the precise repair. That’s empathy in code-land.

Execs & Cons Desk

| Execs | Cons / Caveats |

| Tremendous‑highly effective Pine Script editor + backtesting | Steep studying curve should you don’t code or script |

| Large group & market of methods | Execution not native—wants exterior bot companies |

| Helps multivariable methods, alerts, detailed logic | Alerts and scripts usually behind pay‑wall tiers |

| Paper buying and selling & dwell chart simulator | No direct commerce execution function |

| Works throughout a number of asset courses globally | Danger of over‑optimizing methods on previous information |

What It Feels Like

There have been mornings I woke as much as alerts pinging my telephone—felt like mission management. Different instances, nothing fired all day and I second-guessed the setup. Emotional swings—hope blended with frustration.

Seeing P&L zero out or go pink hit me more durable than anticipated. But debugging scripts—patching code after a false alert—felt oddly satisfying. There’s delight in ironing out bugs, seeing your logic catch a breakout.

Pricing & Worth

TradingView has tiered subscription plans. Free tier provides fundamental charting; paid ranges unlock alerts, multi-timeframe methods, prolonged information, alert amount. No direct commerce automation price—however you’ll pay bot companies individually. Platforms like Tickerly or Cornix begin ~$19–39/month after trials.(turn0search13, turn0search2)

Mixed, worth is affordable—you’re answerable for spend by mixing technique constructing on TradingView with a separate execution layer.

Remaining Verdict (My Two Cents)

TradingView isn’t a turnkey AI‑bot—it’s the canvas the place you design your bots. Should you’re cool with writing or adapting methods, testing them, and hooking as much as exterior execution instruments, this platform is gold. It doesn’t do all the things for you—however it empowers you to do most of it.

Should you’re anticipating an all-in-one hands-off bot answer—you’ll have to look elsewhere or construct the lacking items.

Urged Use Strategy

- Grasp Pine Script through small scripts.

- Backtest with Technique Tester; debug flagged points.

- Set alerts with correct webhook and payload format.

- Use trusted third-party automation companies (Tickerly, Cornix, TradersPost).

- Paper commerce extensively earlier than going dwell.

- Monitor logs, observe efficiency, refine technique periodically.

Backside Line: Ought to You Use TradingView?

Sure—should you’re prepared to study scripting, check completely, and manually bridge execution. It turns into highly effective in the precise arms: a precision software for merchants who like constructing moderately than being handed a black‑field.

Need assist crafting a Pine Script template or establishing alert payloads for a webhook? I’m completely satisfied to assist map it out.