China-based purveyors of SMS phishing kits are having fun with exceptional success changing phished fee card information into cellular wallets from Apple and Google. Till lately, the so-called “Smishing Triad” primarily impersonated toll street operators and transport corporations. However specialists say these teams are actually straight focusing on prospects of worldwide monetary establishments, whereas dramatically increasing their cybercrime infrastructure and assist employees.

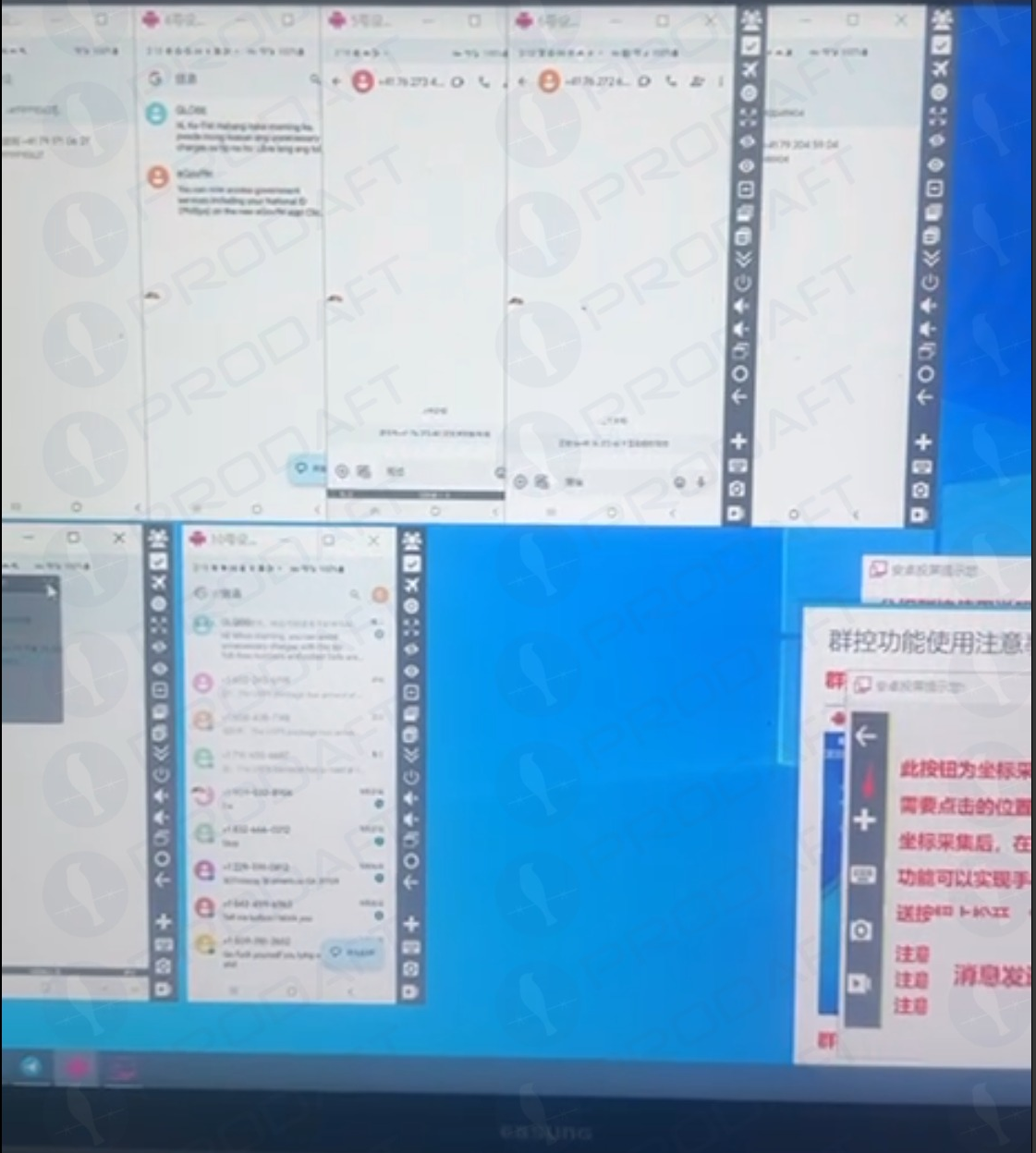

A picture of an iPhone gadget farm shared on Telegram by one of many Smishing Triad members. Picture: Prodaft.

Should you personal a cellular gadget, the possibilities are glorious that sooner or later previously two years you’ve obtained at the very least one on the spot message that warns of a delinquent toll street charge, or a wayward bundle from the U.S. Postal Service (USPS). Those that click on the promoted hyperlink are dropped at a web site that spoofs the USPS or an area toll street operator and asks for fee card info.

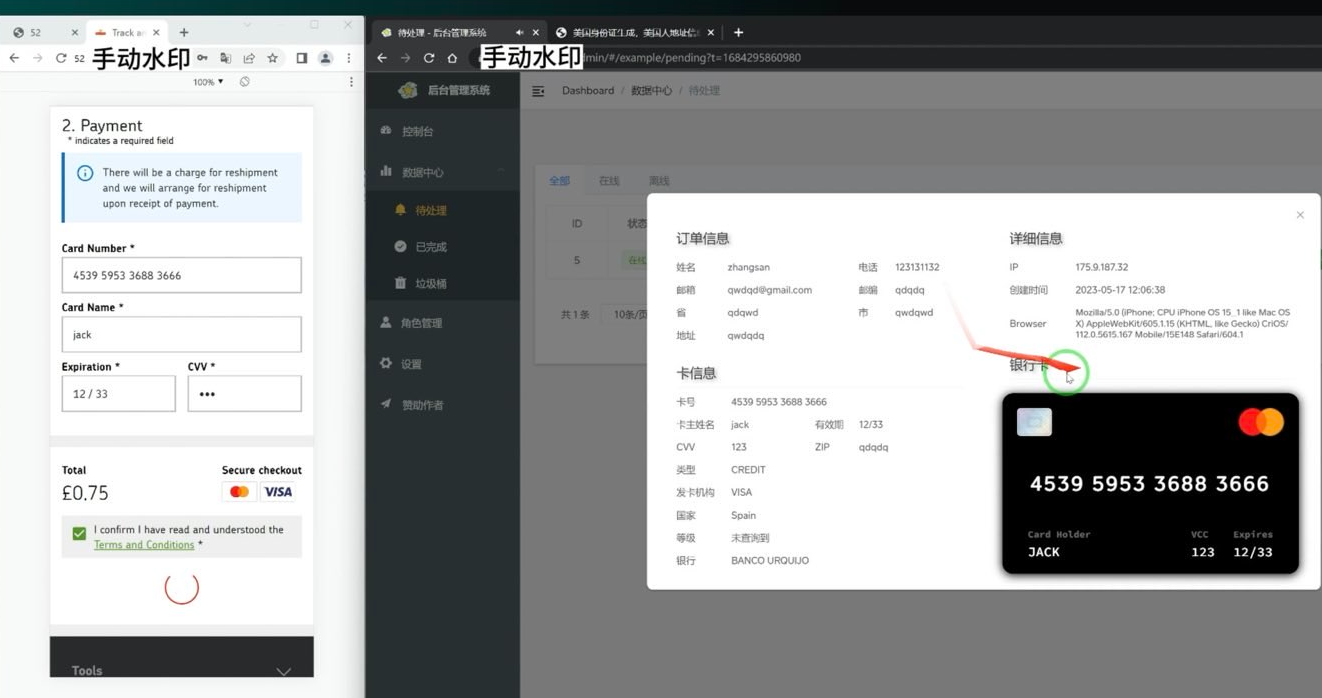

The positioning will then complain that the customer’s financial institution must “confirm” the transaction by sending a one-time code through SMS. In actuality, the financial institution is sending that code to the cellular quantity on file for his or her buyer as a result of the fraudsters have simply tried to enroll that sufferer’s card particulars right into a cellular pockets.

If the customer provides that one-time code, their fee card is then added to a brand new cellular pockets on an Apple or Google gadget that’s bodily managed by the phishers. The phishing gangs usually load a number of stolen digital wallets onto a single Apple or Android gadget, after which promote these telephones in bulk to scammers who use them for fraudulent e-commerce and tap-to-pay transactions.

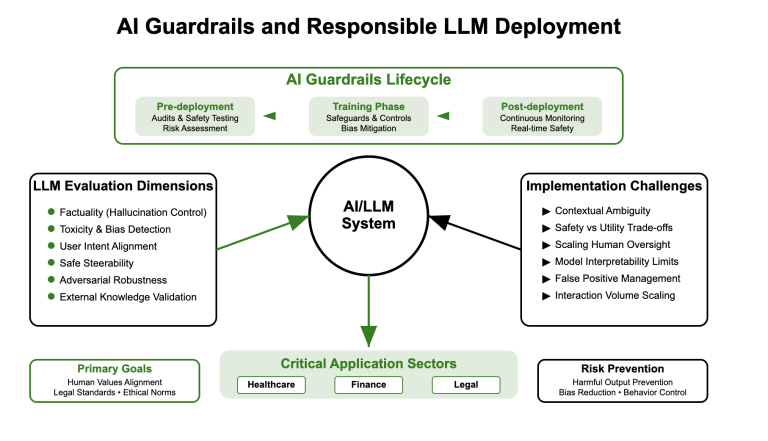

A screenshot of the executive panel for a smishing package. On the left is the (check) information entered on the phishing website. On the correct we are able to see the phishing package has superimposed the equipped card quantity onto a picture of a fee card. When the phishing package scans that created card picture into Apple or Google Pay, it triggers the sufferer’s financial institution to ship a one-time code. Picture: Ford Merrill.

The moniker “Smishing Triad” comes from Resecurity, which was amongst the primary to report in August 2023 on the emergence of three distinct cellular phishing teams primarily based in China that appeared to share some infrastructure and modern phishing strategies. However it’s a little bit of a misnomer as a result of the phishing lures blasted out by these teams usually are not SMS or textual content messages within the standard sense.

Slightly, they’re despatched through iMessage to Apple gadget customers, and through RCS on Google Android units. Thus, the missives bypass the cell phone networks solely and revel in close to 100% supply charge (at the very least till Apple and Google droop the spammy accounts).

In a report revealed on March 24, the Swiss menace intelligence agency Prodaft detailed the speedy tempo of innovation coming from the Smishing Triad, which it characterizes as a loosely federated group of Chinese language phishing-as-a-service operators with names like Darcula, Lighthouse, and the Xinxin Group.

Prodaft stated they’re seeing a major shift within the underground financial system, notably amongst Chinese language-speaking menace actors who’ve traditionally operated within the shadows in comparison with their Russian-speaking counterparts.

“Chinese language-speaking actors are introducing modern and cost-effective programs, enabling them to focus on bigger consumer bases with refined providers,” Prodaft wrote. “Their method marks a brand new period in underground enterprise practices, emphasizing scalability and effectivity in cybercriminal operations.”

A new report from researchers on the safety agency SilentPush finds the Smishing Triad members have expanded into promoting cellular phishing kits focusing on prospects of worldwide monetary establishments like CitiGroup, MasterCard, PayPal, Stripe, and Visa, in addition to banks in Canada, Latin America, Australia and the broader Asia-Pacific area.

Phishing lures from the Smishing Triad spoofing PayPal. Picture: SilentPush.

SilentPush discovered the Smishing Triad now spoofs recognizable manufacturers in a wide range of trade verticals throughout at the very least 121 nations and an unlimited variety of industries, together with the postal, logistics, telecommunications, transportation, finance, retail and public sectors.

Based on SilentPush, the domains utilized by the Smishing Triad are rotated often, with roughly 25,000 phishing domains lively throughout any 8-day interval and a majority of them sitting at two Chinese language internet hosting corporations: Tencent (AS132203) and Alibaba (AS45102).

“With practically two-thirds of all nations on the planet focused by [the] Smishing Triad, it’s secure to say they’re basically focusing on each nation with trendy infrastructure outdoors of Iran, North Korea, and Russia,” SilentPush wrote. “Our crew has noticed some potential focusing on in Russia (equivalent to domains that talked about their nation codes), however nothing definitive sufficient to point Russia is a persistent goal. Apparently, although these are Chinese language menace actors, we’ve seen situations of focusing on aimed toward Macau and Hong Kong, each particular administrative areas of China.”

SilentPush’s Zach Edwards stated his crew discovered a vulnerability that uncovered information from one of many Smishing Triad’s phishing pages, which revealed the variety of visits every website obtained every day throughout hundreds of phishing domains that had been lively on the time. Primarily based on that information, SilentPush estimates these phishing pages obtained nicely greater than 1,000,000 visits inside a 20-day time span.

The report notes the Smishing Triad boasts it has “300+ entrance desk employees worldwide” concerned in one in all their extra fashionable phishing kits — Lighthouse — employees that’s primarily used to assist numerous facets of the group’s fraud and cash-out schemes.

The Smishing Triad members preserve their very own Chinese language-language gross sales channels on Telegram, which often supply movies and pictures of their employees arduous at work. A few of these photos embrace large partitions of telephones used to ship phishing messages, with human operators seated straight in entrance of them able to obtain any time-sensitive one-time codes.

As famous in February’s story How Phished Information Turns Into Apple and Google Wallets, a kind of cash-out schemes includes an Android app referred to as Z-NFC, which may relay a sound NFC transaction from one in all these compromised digital wallets to wherever on the planet. For a $500 month subscription, the shopper can wave their telephone at any fee terminal that accepts Apple or Google pay, and the app will relay an NFC transaction over the Web from a stolen pockets on a telephone in China.

Chinese language nationals had been lately busted attempting to make use of these NFC apps to purchase high-end electronics in Singapore. And in the US, authorities in California and Tennessee arrested Chinese language nationals accused of utilizing NFC apps to fraudulently buy reward playing cards from retailers.

The Prodaft researchers stated they had been capable of finding a beforehand undocumented backend administration panel for Lucid, a smishing-as-a-service operation tied to the XinXin Group. The panel included sufferer figures that recommend the smishing campaigns preserve a mean success charge of roughly 5 p.c, with some domains receiving over 500 visits per week.

“In a single noticed occasion, a single phishing web site captured 30 bank card information from 550 sufferer interactions over a 7-day interval,” Prodaft wrote.

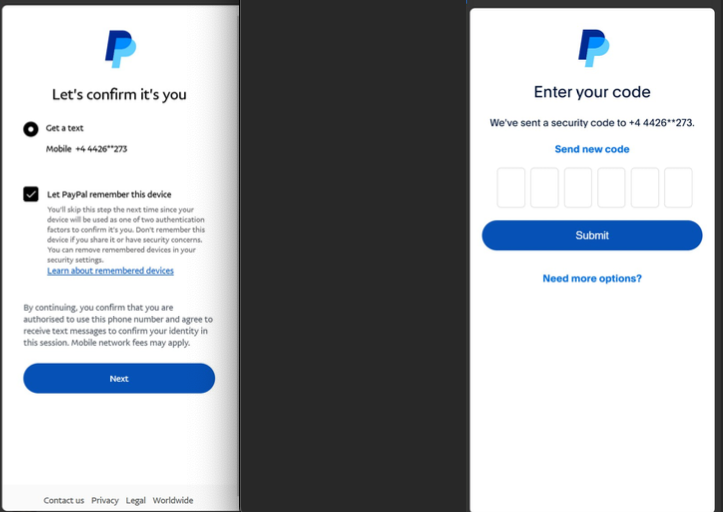

Prodaft’s report particulars how the Smishing Triad has achieved such success in sending their spam messages. For instance, one phishing vendor seems to ship out messages utilizing dozens of Android gadget emulators operating in parallel on a single machine.

Phishers utilizing a number of virtualized Android units to orchestrate and distribute RCS-based rip-off campaigns. Picture: Prodaft.

Based on Prodaft, the menace actors first purchase telephone numbers via numerous means together with information breaches, open-source intelligence, or bought lists from underground markets. They then exploit technical gaps in sender ID validation inside each messaging platforms.

“For iMessage, this includes creating momentary Apple IDs with impersonated show names, whereas RCS exploitation leverages provider implementation inconsistencies in sender verification,” Prodaft wrote. “Message supply happens via automated platforms utilizing VoIP numbers or compromised credentials, typically deployed in exactly timed multi-wave campaigns to maximise effectiveness.

As well as, the phishing hyperlinks embedded in these messages use time-limited single-use URLs that expire or redirect primarily based on gadget fingerprinting to evade safety evaluation, they discovered.

“The economics strongly favor the attackers, as neither RCS nor iMessage messages incur per-message prices like conventional SMS, enabling high-volume campaigns at minimal operational expense,” Prodaft continued. “The overlap in templates, goal swimming pools, and techniques amongst these platforms underscores a unified menace panorama, with Chinese language-speaking actors driving innovation within the underground financial system. Their means to scale operations globally and evasion strategies pose important challenges to cybersecurity defenses.”

Ford Merrill works in safety analysis at SecAlliance, a CSIS Safety Group firm. Merrill stated he’s noticed at the very least one video of a Home windows binary that wraps a Chrome executable and can be utilized to load in goal telephone numbers and blast messages through RCS, iMessage, Amazon, Instagram, Fb, and WhatsApp.

“The proof we’ve noticed suggests the flexibility for a single gadget to ship roughly 100 messages per second,” Merrill stated. “We additionally imagine that there’s functionality to supply nation particular SIM playing cards in quantity that permit them to register totally different on-line accounts that require validation with particular nation codes, and even make these SIM playing cards out there to the bodily units long-term in order that providers that depend on checks of the validity of the telephone quantity or SIM card presence on a cellular community are thwarted.”

Consultants say this fast-growing wave of card fraud persists as a result of far too many monetary establishments nonetheless default to sending one-time codes through SMS for validating card enrollment in cellular wallets from Apple or Google. KrebsOnSecurity interviewed a number of safety executives at non-U.S. monetary establishments who spoke on situation of anonymity as a result of they weren’t licensed to talk to the press. These banks have since completed away with SMS-based one-time codes and are actually requiring prospects to log in to the financial institution’s cellular app earlier than they’ll hyperlink their card to a digital pockets.